In this blog, we explore some of the top 5 accounting softwares in South Africa. Managing finances efficiently is crucial for the success of any business, especially in a competitive market like South Africa. With the right accounting software, companies can streamline operations, maintain compliance, and make informed decisions. This blog explores the top five accounting software options tailored to the unique needs of South African businesses, highlighting their features, benefits, and why they are trusted by companies across various industries. Whether you’re a small startup or a growing enterprise, these tools can help optimize your financial management processes.

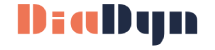

1. Diadyn Finance & Accounting

Diadyn Finance and Accounts is a dynamic solution designed for businesses of all sizes. It simplifies financial processes with intuitive features for bookkeeping, invoicing, and expense tracking. With real-time financial insights and customizable reports, it’s ideal for businesses aiming for growth. The software also emphasizes user-friendliness and scalability, making it a top choice for South African SMEs.

Key Features:

- Real-Time Financial Tracking: Gain instant insights into your financial status with up-to-date tracking tools. Diadyn Finance and Accounting is a cutting-edge feature that provides instant visibility into an organization’s financial data. This functionality ensures that businesses can make data-driven decisions with up-to-the-minute insights into their financial performance.

- Customizable Invoicing: Create professional, branded invoices tailored to your business needs. Customizable invoicing in Diadyn Finance and Accounting provides businesses with the flexibility to create, manage, and personalize invoices tailored to their specific branding and operational requirements. This feature streamlines the invoicing process, enhances professionalism, and improves the customer experience.

- Expense Management: Expense management in Diadyn Finance and Accounting offers a comprehensive solution for tracking, categorizing, and controlling business expenses. This feature ensures transparency, reduces errors, and enhances financial efficiency by automating and streamlining the expense tracking process.

- Integration Capabilities: Connect seamlessly with other diadyn business applications for enhanced functionality.

- User-Friendly Interface: A user-friendly interface is a cornerstone of Diadyn Finance and Accounting, designed to enhance usability, simplify complex processes, and ensure users can manage their financial tasks efficiently without extensive training. The intuitive design prioritizes ease of navigation, accessibility, and an overall seamless user experience.

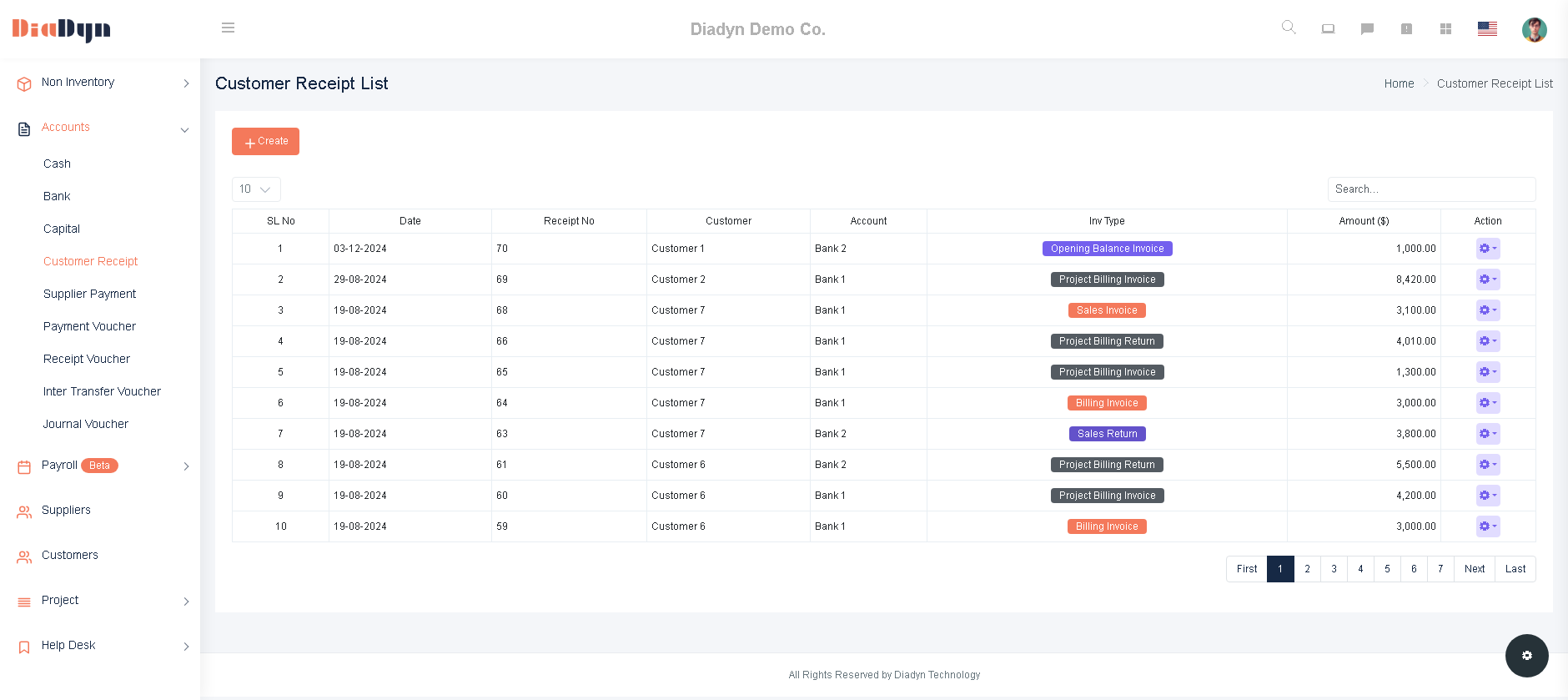

2. Sage Business Cloud Accounting

Sage Business Cloud Accounting is a powerful and intuitive cloud-based solution designed to simplify financial management for businesses. It offers essential tools like invoicing, expense tracking, and tax compliance tailored to the South African market. Its flexibility allows users to access their accounts anytime, while features such as payroll integration, advanced reporting, and bank reconciliation streamline accounting tasks.

Key Features:

-

- Cloud-Based Accessibility : The Cloud-Based Accessibility feature in Sage Business Cloud Accounting is a cornerstone of its functionality, allowing users to manage their accounting tasks from virtually anywhere with an internet connection. This feature enables flexibility, real-time collaboration, and increased efficiency for businesses, particularly in today’s remote and mobile work environments. Access your accounts anytime, anywhere, and on any device, ensuring flexibility for business owners and accountants.

- Localized Tax Compliance: The Localized Tax Compliance feature in Sage Business Cloud Accounting ensures businesses can comply with regional tax laws and regulations, regardless of their geographic location. This feature is particularly beneficial for small and growing businesses that need to manage taxes effectively without specialized expertise. Sage incorporates various tax rules, rates, and reporting formats to simplify tax management and compliance for users worldwide.Sage is tailored for South African businesses with VAT calculations and local tax compliance features.

- Invoicing and Payments: The Invoicing and Payments feature in Sage Business Cloud Accounting is designed to streamline how businesses manage billing and receive payments. It offers robust tools for creating professional invoices, automating payment tracking, and improving cash flow by integrating various payment methods. This feature is ideal for businesses of all sizes that want to simplify financial transactions while maintaining professionalism

- Advanced Reporting: The Advanced Reporting feature in Sage Business Cloud Accounting provides businesses with comprehensive insights into their financial performance. By leveraging detailed, customizable reports, this feature enables users to analyze their financial data, make informed decisions, and maintain compliance with regulatory requirements. It’s particularly useful for small and growing businesses looking to track progress, optimize operations, and strategically plan for the future.

- Bank Reconciliation: The Advanced Reporting feature in Sage Business Cloud Accounting provides businesses with comprehensive insights into their financial performance. By leveraging detailed, customizable reports, this feature enables users to analyze their financial data, make informed decisions, and maintain compliance with regulatory requirements. It’s particularly useful for small and growing businesses looking to track progress, optimize operations, and strategically plan for the future.

- User-Friendly Interface: Simplifies complex accounting tasks, making it suitable even for users without an accounting background.

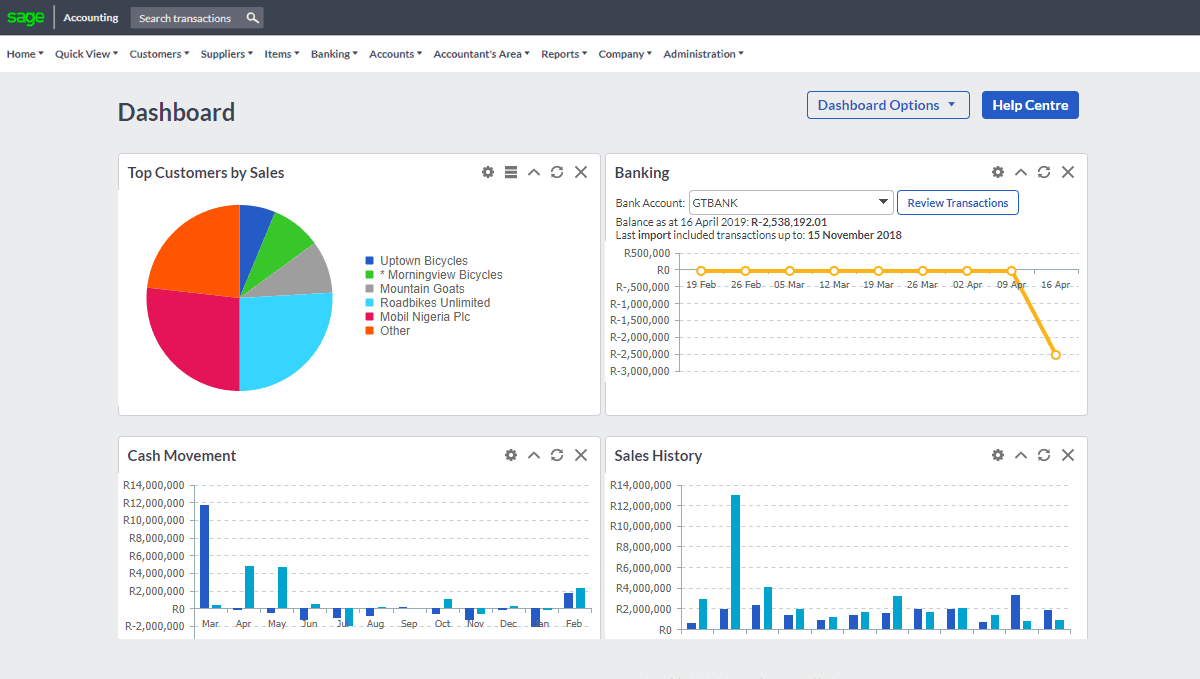

3. QuickBook

QuickBooks Online is a versatile, cloud-based accounting software designed to meet the needs of small and medium-sized businesses. Known for its simplicity and efficiency, it offers tools for managing invoices, tracking expenses, reconciling bank accounts, and generating detailed financial reports. QuickBooks supports multi-currency transactions and integrates seamlessly with payroll systems and third-party applications.

Key Features :

- Invoicing and Payments: QuickBooks provides robust tools for creating, managing, and tracking invoices and bills, streamlining the process of getting paid by clients and managing vendor payments. Users can generate invoices tailored to their business branding, including logos, colors, and fonts. Fields for item descriptions, quantity, price, and taxes can be adjusted to suit the transaction.

- Bank Reconciliation: The bank reconciliation feature in QuickBooks helps businesses ensure that their financial records accurately reflect the transactions in their bank accounts. This process involves matching the transactions in QuickBooks with the statements provided by the bank to identify discrepancies and maintain accurate financial records.

- Multi-Currency Support: The multi-currency support feature in QuickBooks is designed to help businesses manage transactions in multiple currencies. This is particularly useful for companies that operate internationally, deal with foreign clients or vendors, and need accurate financial records reflecting various currencies.

- Financial Reporting: The financial reporting feature in QuickBooks provides comprehensive tools for generating detailed reports to analyze the financial health of a business. These reports cover various aspects, including income, expenses, profitability, and cash flow, offering valuable insights for decision-making and compliance. QuickBooks’ financial reporting features empower businesses to maintain accurate records, monitor performance, and plan effectively for the future.

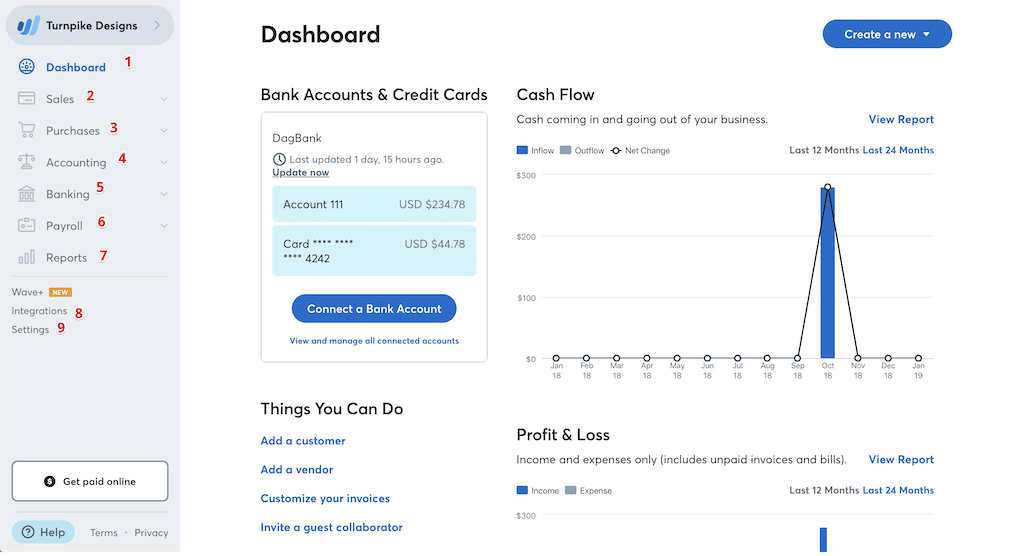

4.Wave Accounting

Wave Accounting is a cloud-based accounting and financial management platform specifically designed for small businesses, freelancers, and entrepreneurs. Known for its simplicity and affordability, Wave empowers users to efficiently manage their financial tasks, from invoicing and expense tracking to payment processing, without the high costs often associated with accounting software.

Key Features :

- Invoicing :Wave Accounting’s invoicing feature is a powerful and intuitive tool designed to help businesses manage billing efficiently, maintain professionalism, and get paid faster.Wave’s invoicing feature combines professional-quality tools, automation, and convenience into one easy-to-use platform. With no cost for core features, it’s an excellent solution for small businesses, freelancers, and entrepreneurs who want to streamline their invoicing process without breaking the bank.

- Expense Tracking : Wave Accounting’s Expense Tracking feature is designed to streamline the management of business expenses. It simplifies tracking, categorizing, and reconciling expenses, ensuring your books are accurate and your finances are well-organized. Wave’s expense tracking is an essential tool for small businesses, freelancers, and entrepreneurs. It automates tedious tasks, provides real-time financial insights, and ensures your books are accurate. Whether you need to stay on top of daily expenses, prepare for tax season, or manage international transactions, Wave makes it simple, efficient, and accessible all without a monthly subscription fee.

- Accounting : It automates bookkeeping tasks, provides real-time insights into financial health, and ensures compliance with accounting standards. By automating tedious tasks and providing real-time financial insights, Wave empowers users to focus on growing their business while staying on top of their finances all for free.

- Payments : Payments feature is designed to help businesses efficiently manage their incoming payments and streamline the process of collecting payments from clients. Whether you’re working with invoices, subscriptions, or one-time payments, Wave makes it easy to track and process payments.

- Reporting : Reporting feature is an essential tool for business owners, freelancers, and accountants to analyze financial data, monitor performance, and make informed decisions. This feature generates various reports that provide a clear picture of the financial health of a business. These reports can be customized, exported, and used for tax filing or financial analysis.

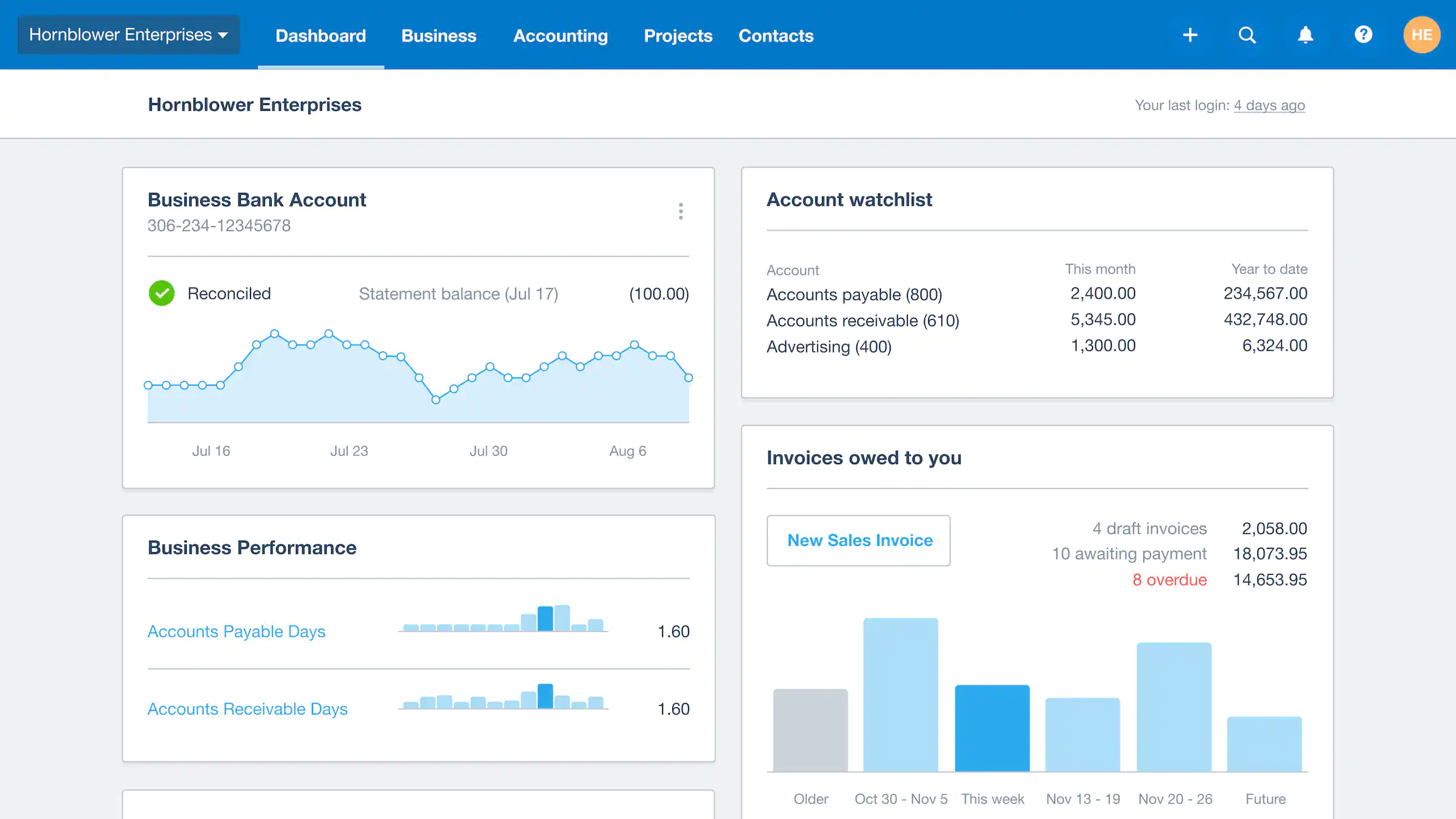

5. Xero

Xero is a comprehensive cloud-based accounting software designed to help small and medium-sized businesses (SMBs) manage their finances efficiently. Xero has grown to become one of the leading accounting platforms globally, with a focus on ease of use, integration capabilities, and scalability. It offers a suite of features that simplify accounting tasks such as invoicing, expense tracking, bank reconciliation, payroll, reporting, and more.

Key Features :

- Bank Reconciliation : Xero makes bank reconciliation easy and efficient . Xero connects to your bank and automatically imports transaction data, saving time on manual entry. The platform suggests matching bank transactions to existing entries, making it easier to reconcile accounts. If there are discrepancies, users can manually match or adjust transactions, ensuring accurate reconciliation.

- Financial Reporting : Xero provides robust reporting tools to help businesses understand their financial performance. Generate real-time profit and loss reports to understand business income and expenses. View a snapshot of your company’s assets, liabilities, and equity to assess its financial health. Monitor your business’s cash flow to ensure you have enough liquidity to cover expenses.

- Tax Management : Xero helps businesses manage their taxes efficiently. Set up tax rates (e.g., VAT, sales tax) and apply them automatically to transactions. Xero supports tax calculations and reporting in multiple countries, making it suitable for businesses with international operations.

- Invoicing : Xero simplifies the process of creating, sending, and managing invoices. Choose from a variety of templates, and personalize invoices with your business logo, payment terms, and branding. Automatically track the status of invoices (sent, viewed, paid, overdue) and send reminders for overdue payments.

- Expense Tracking : Xero helps businesses track and manage expense. Classify expenses into categories for better tracking and reporting (e.g., office supplies, utilities, etc.). Xero connects directly with bank accounts to automatically import and categorize expenses, reducing manual data entry. Using the mobile app, users can snap photos of receipts and link them directly to expense transactions.